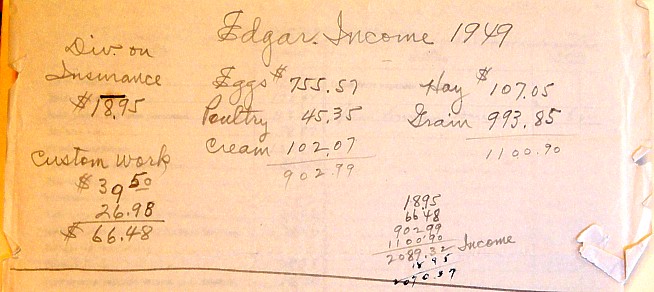

Hay

Cream

Eggs

Poultry

Custom work

Total

$107.05

$102.07

$755.57

$ 45.35

$ 66.48

$2,070.37

Over the years, both my grandparents and my parents had tried any number of ways to make a living. It appears that 1949 was when they were heavy into the

egg business, complemented by crops and some dairying.

Much like today for anyone who itemizes deductions, the list of expenses was long:

Feed

Seeds/plants

Machine hire

Supplies

Repairs

Veterinary

Gas/fuel/oil

Taxes

Insurance

Interest

Electricity

Phone

Dues

Auto upkeep

Depreciation

Total

$171.42

$113.06

$79.87

$155.10

$56.44

$20.66

$139.64

$28.95

$26.40

$38.12

$30.00

$11.80

$8.00

$234.63

$225.84

$1,412.74

The difference between the two yielded the profit for 1949 - a whopping $657.63!

These figures seem laughably small today, but even using the adjusted value of the dollar, it doesn't amount to much.

The dollar in 1949 bought almost exactly 10 times as much as today's dollar. But a profit on a business of between

$6,000 and $7,000 in today's money still seems pretty small.

Mom had taught before she and Dad married in 1946, but once David was born, she took a 12-year hiatus to raise her

children. In 1959, she began teaching again. That year she earned $1,725 as a teacher and Dad earned $3,015 as a school

bus driver and $1,001.59 for the farm. Again adjusting for the value of the dollar, her income today would have been

almost $14,000. Dad's bus driving earnings would be equal to about $24,000 and the farm income would have been a bit

more than $8,000.

Pausing to think a bit revealed another truth. I was born in 1953 and grew up on the farm. So I have always thought

of my family as being farmers. But the figures say something a bit different. We may have lived on a farm and done

some farming, but my folks were really supporting the family by working at jobs off the farm.

This also explains something that happened in 1962. For many years, Dad had been driving a 1952 Ford bus. But in May

of 1962, the family traveled by train to Lima, Ohio to pick up a new Chevy bus. I clearly recall riding all the way

home to Kansas, bouncing around on the back seats as I tried to sleep. In recent years, my siblings and I had tried

to remember the year we bought that bus, but that 1962 tax form listing it as an expense nailed down when it happened.

But I had always thought of Dad's delivering kids to school and returning them after school as sort of an extra job.

Yet when I saw how much income that work brought into the family, I can understand why buying a new bus made sense.

A small detail noted from the 1964 tax forms was that it was completed by Dave. He later received his bachelor's and

master's degrees in accounting. Was he trying his hand at his future profession while still in high school?

Grandpa and Grandma Freeland's income tax forms were not as detailed as those of my folks. Grandpa listed himself as a

farmer through 1959, but as a retired farmer after.

Tucked in with the returns were hand-written lists of income and expenses, and a couple of those were written on the

back of letters from Capper's Weekly, a newspaper founded in 1913 that focused on rural living. The annual subscription

was a whopping $2. Today, it's published as a bi-weekly magazine called Capper's Farmer, but the subscription still is

a reasonable $14.95 a year.

But now that I've read through all of this, what should I do with this stuff? Should I keep it or just shred it?

Ah, neither! I'll give it all to Dave ... who is also a collector. He can sort it out!

It appears that scribbling notes while preparing a tax return was as common then as it is now.

Comments? [email protected].

Earlier columns from 2014 may be found at: 2014 Index.

Links to previous years are on the home page: Home